What Is The Tax Rate On Alcohol . only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. taxation of alcoholic beverages. taxation of alcoholic beverages. per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer. Wine and ethanol for industrial purposes. By raising the price of alcohol, taxes efectively. alcohol taxes play a crucial role in reducing alcohol consumption and harms. the duty levied on still and sparkling wine and other fermented drinks (e.g. This database, compiled for the first time, provides standardized indicators of price and tax level for. Tax is levied on spirits and beer in switzerland. a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: Vat/gst and excise rates, trends and policy issues. global prices and taxes on alcoholic beverages. Cider and perry) and intermediate products (e.g.

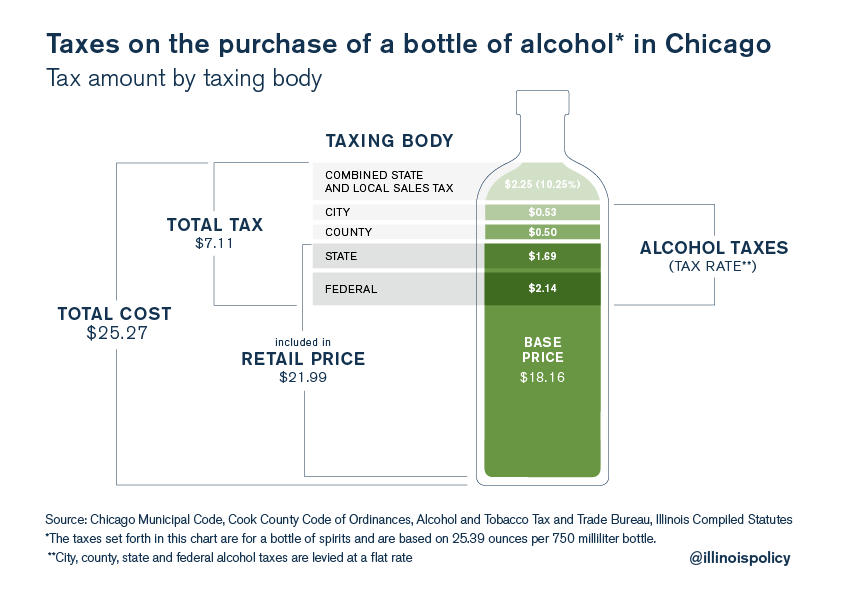

from www.illinoispolicy.org

Tax is levied on spirits and beer in switzerland. per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer. This database, compiled for the first time, provides standardized indicators of price and tax level for. Wine and ethanol for industrial purposes. By raising the price of alcohol, taxes efectively. global prices and taxes on alcoholic beverages. alcohol taxes play a crucial role in reducing alcohol consumption and harms. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. Vat/gst and excise rates, trends and policy issues. a reduced rate of 2,6 % applies for certain categories of goods and services, particularly:

Chicago’s total, effective tax rate on liquor is 28

What Is The Tax Rate On Alcohol Wine and ethanol for industrial purposes. By raising the price of alcohol, taxes efectively. taxation of alcoholic beverages. global prices and taxes on alcoholic beverages. Vat/gst and excise rates, trends and policy issues. This database, compiled for the first time, provides standardized indicators of price and tax level for. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer. taxation of alcoholic beverages. a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: the duty levied on still and sparkling wine and other fermented drinks (e.g. Cider and perry) and intermediate products (e.g. Tax is levied on spirits and beer in switzerland. alcohol taxes play a crucial role in reducing alcohol consumption and harms. Wine and ethanol for industrial purposes.

From www.researchgate.net

Alcohol Tax Revenues as a Percent of Total Maryland Revenues, 19772006 What Is The Tax Rate On Alcohol Wine and ethanol for industrial purposes. global prices and taxes on alcoholic beverages. Cider and perry) and intermediate products (e.g. This database, compiled for the first time, provides standardized indicators of price and tax level for. a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: per ounce of alcohol, spirits are. What Is The Tax Rate On Alcohol.

From www.pinterest.com

Map of State Spirits Excise Tax Rates in 2015 Tax Foundation What Is The Tax Rate On Alcohol global prices and taxes on alcoholic beverages. Wine and ethanol for industrial purposes. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. This database, compiled for the first time, provides standardized indicators of price and tax level for. taxation of. What Is The Tax Rate On Alcohol.

From www.taxpolicycenter.org

State Alcohol Excise Tax Rates Tax Policy Center What Is The Tax Rate On Alcohol global prices and taxes on alcoholic beverages. By raising the price of alcohol, taxes efectively. Tax is levied on spirits and beer in switzerland. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. Vat/gst and excise rates, trends and policy issues.. What Is The Tax Rate On Alcohol.

From www.taxpolicycenter.org

State Alcohol Excise Taxes Tax Policy Center What Is The Tax Rate On Alcohol alcohol taxes play a crucial role in reducing alcohol consumption and harms. By raising the price of alcohol, taxes efectively. taxation of alcoholic beverages. Tax is levied on spirits and beer in switzerland. This database, compiled for the first time, provides standardized indicators of price and tax level for. Wine and ethanol for industrial purposes. per ounce. What Is The Tax Rate On Alcohol.

From taxfoundation.org

How High Are Beer Taxes in Your State? Tax Foundation What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. This database, compiled for the first time, provides standardized indicators of price and tax level for. Vat/gst and excise rates, trends and policy issues. alcohol taxes play a crucial role in reducing alcohol consumption and harms. Cider and perry) and intermediate products (e.g. per. What Is The Tax Rate On Alcohol.

From www.ias.org.uk

How have UK alcohol taxes changed over time? IAS What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. taxation of alcoholic beverages. Tax is levied on spirits and beer in switzerland. per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer. By raising the price of alcohol, taxes efectively. alcohol. What Is The Tax Rate On Alcohol.

From www.researchgate.net

Average alcohol tax rate, 19501990. Download Scientific Diagram What Is The Tax Rate On Alcohol taxation of alcoholic beverages. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. alcohol taxes play a crucial role in reducing alcohol consumption and harms. By raising the price of alcohol, taxes efectively. Vat/gst and excise rates, trends and policy. What Is The Tax Rate On Alcohol.

From dxolfranm.blob.core.windows.net

What Is The Sales Tax On Alcohol In New York at Joseph Neal blog What Is The Tax Rate On Alcohol alcohol taxes play a crucial role in reducing alcohol consumption and harms. This database, compiled for the first time, provides standardized indicators of price and tax level for. taxation of alcoholic beverages. global prices and taxes on alcoholic beverages. Tax is levied on spirits and beer in switzerland. By raising the price of alcohol, taxes efectively. . What Is The Tax Rate On Alcohol.

From addiction-dirkh.blogspot.com

Addiction Inbox Tripling the Tax on Alcohol What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. global prices and taxes on alcoholic beverages. a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: Wine and ethanol for industrial purposes. Cider and perry) and intermediate products (e.g. only 50% of member states levy any duty. What Is The Tax Rate On Alcohol.

From www.taxpolicycenter.org

Alcohol Tax Revenue by State FF (04.05.2021) Tax Policy Center What Is The Tax Rate On Alcohol taxation of alcoholic beverages. This database, compiled for the first time, provides standardized indicators of price and tax level for. global prices and taxes on alcoholic beverages. Vat/gst and excise rates, trends and policy issues. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to. What Is The Tax Rate On Alcohol.

From taxesalert.com

How High are Distilled Spirits Taxes in Your State? Taxes Alert What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. Vat/gst and excise rates, trends and policy issues. alcohol taxes play a crucial role in reducing alcohol consumption and harms. taxation of alcoholic beverages. taxation of alcoholic beverages. This database, compiled for the first time, provides standardized indicators of price and tax level. What Is The Tax Rate On Alcohol.

From taxfoundation.org

Liqour Taxes How High Are Distilled Spirits Taxes in Your State? What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. taxation of alcoholic beverages. Wine and ethanol for industrial purposes. This database, compiled for the first time, provides. What Is The Tax Rate On Alcohol.

From www.changelabsolutions.org

Introduction to Alcohol Taxes ChangeLab Solutions What Is The Tax Rate On Alcohol global prices and taxes on alcoholic beverages. per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer. the duty levied on still and sparkling wine and other fermented drinks (e.g. Tax is levied on spirits and beer in switzerland. Cider and perry) and intermediate products (e.g.. What Is The Tax Rate On Alcohol.

From reason.com

These States Have the Highest and Lowest Alcohol Taxes What Is The Tax Rate On Alcohol a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: global prices and taxes on alcoholic beverages. taxation of alcoholic beverages. the duty levied on still and sparkling wine and other fermented drinks (e.g. only 50% of member states levy any duty on wine and several levy duty on spirits. What Is The Tax Rate On Alcohol.

From wisevoter.com

Alcohol Tax by State 2023 Wisevoter What Is The Tax Rate On Alcohol a reduced rate of 2,6 % applies for certain categories of goods and services, particularly: alcohol taxes play a crucial role in reducing alcohol consumption and harms. Cider and perry) and intermediate products (e.g. Vat/gst and excise rates, trends and policy issues. per ounce of alcohol, spirits are taxed at more than three times the rate of. What Is The Tax Rate On Alcohol.

From mapsontheweb.zoom-maps.com

Alcohol tax rate by US state. Maps on the What Is The Tax Rate On Alcohol the duty levied on still and sparkling wine and other fermented drinks (e.g. alcohol taxes play a crucial role in reducing alcohol consumption and harms. Tax is levied on spirits and beer in switzerland. taxation of alcoholic beverages. By raising the price of alcohol, taxes efectively. Wine and ethanol for industrial purposes. Vat/gst and excise rates, trends. What Is The Tax Rate On Alcohol.

From www.cambridge.org

Consumer Taxes on Alcohol An International Comparison over Time What Is The Tax Rate On Alcohol global prices and taxes on alcoholic beverages. Cider and perry) and intermediate products (e.g. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. taxation of alcoholic beverages. By raising the price of alcohol, taxes efectively. a reduced rate of. What Is The Tax Rate On Alcohol.

From www.pennlive.com

What states have the largest tax rate for alcohol? What Is The Tax Rate On Alcohol taxation of alcoholic beverages. Tax is levied on spirits and beer in switzerland. only 50% of member states levy any duty on wine and several levy duty on spirits and beer at or close to the eu minimum level. This database, compiled for the first time, provides standardized indicators of price and tax level for. global prices. What Is The Tax Rate On Alcohol.